oklahoma franchise tax phone number

1099 State Filing Requirements - Tax1099 updates state by state listing of what 1099 MISC state reporting information you need to e-File with IRS. Gross Production Lease Records.

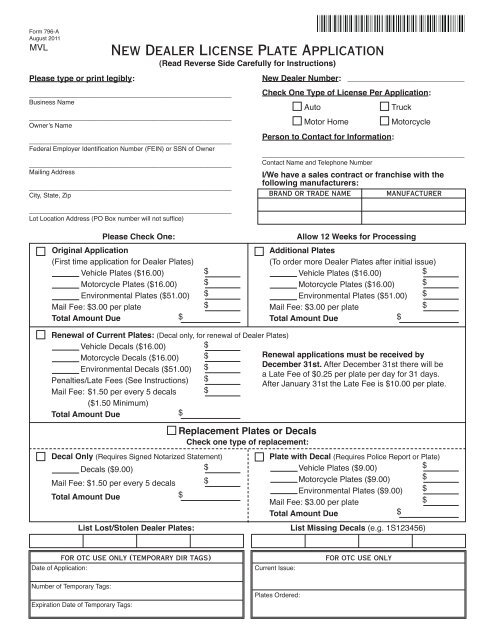

New Dealer License Plate Application Oklahoma Tax Commission

We will be sure to contact you when it is convenient for you.

. Oklahoma Tax Commission Division Phone Numbers. He and I have more than 10 hours of trying every phone number on letter plus our local office. Most title companies will accept this as proof a lien will be removed.

Tax debtors who owe between 50000 and 250000 have a new option with the IRS. Gross Production 405 521-3251. Schedule attend a commercial cleaning franchise disclosure presentation.

Franchise Tax 405 521-3160. We receive payment in full in guaranteed funds certified. Online tool or by calling the toll-free telephone number 866-464-2050 three weeks after you file your amended return.

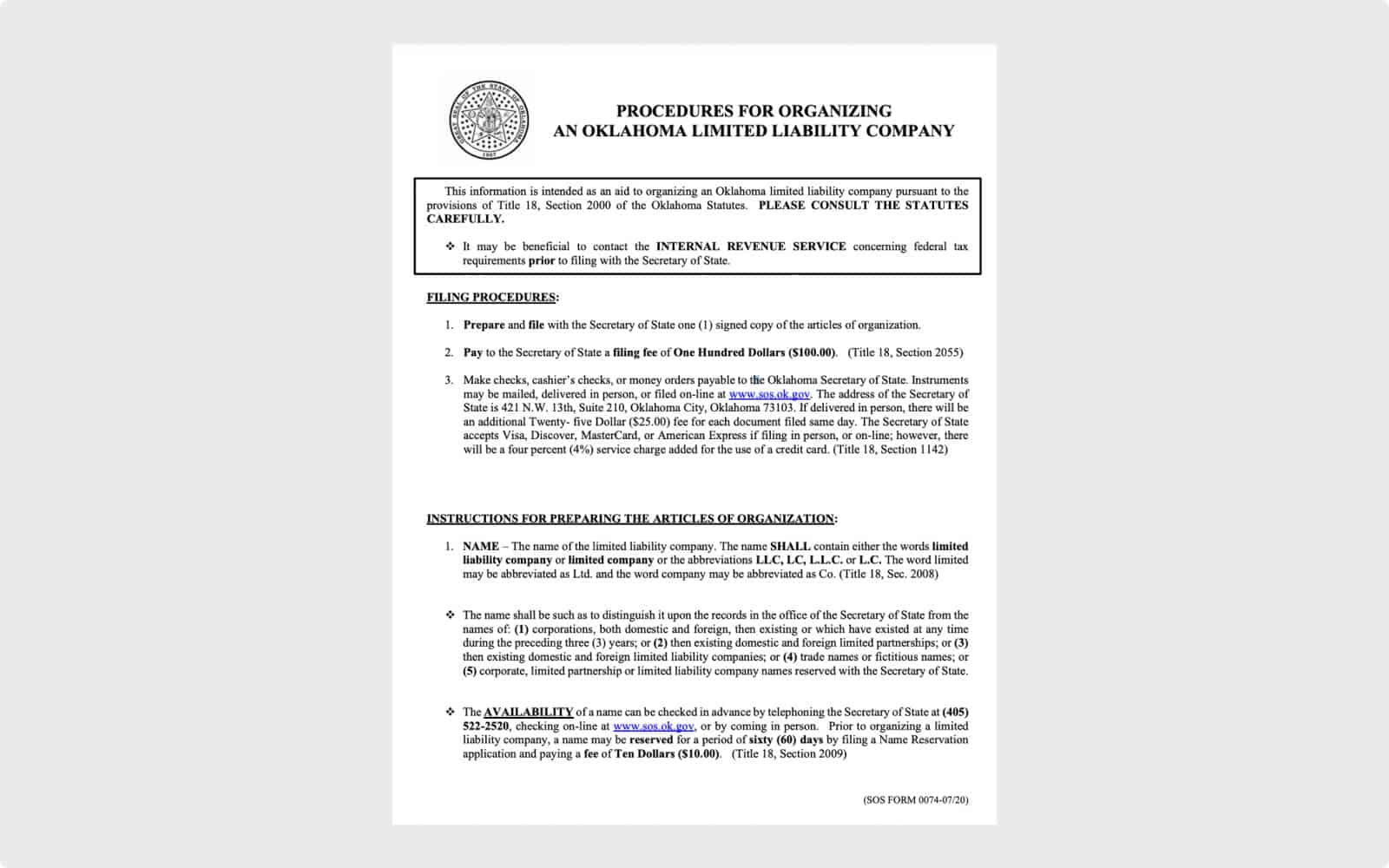

The main cost of forming a limited liability company LLC is the state filing feeThis fee ranges between 40 and 500 depending on your state. Federal Tax Name - or - Social Security Number individual will receive a 1099 if more than 600 is paid in a calendar year By clicking on the Submit button you are confirming that the information you. Or you can use our free Form an LLC guide to do it yourself.

And text messages using an automatic telephone dialing system or an artificial or prerecorded voice to my phone number above. Ad Valorem 405 319-8200. A Notice of Pending Warrant Satisfaction verifies we are in the process of satisfying your tax warrant.

Your payment amount is the same as your routing number account number or phone number. Individual Income Tax Return using the Wheres My Amended Return. You can hire a professional LLC formation service to set up your LLC for an additional small fee.

Your data is secured with SSL Secure Socket Layer and 128-bit encryption. If I provided a cell phone number or a number later converted to a cell I agree that. We can send you a Notice of Pending Warrant Satisfaction if.

Only you or your authorized representative may request this notice. Both tools are available in English and Spanish and track the status of amended returns for the current year and up to. There are two options for forming your LLC.

You can check the status of your Form 1040-X Amended US. Phone Email Desired B-Dubs Location. Account Maintenance 405 521-4271.

The new non-streamlined installment agreement. Please provide specific notes to let us know the best way to reach you phone email etc and the times that work best daytime evening weekends. Safety measures are in place to protect your tax information.

Fill Free Fillable 2021 Form 512 Oklahoma Corporation Income And Franchise Tax Return Packet Instructions State Of Oklahoma Pdf Form

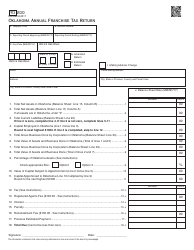

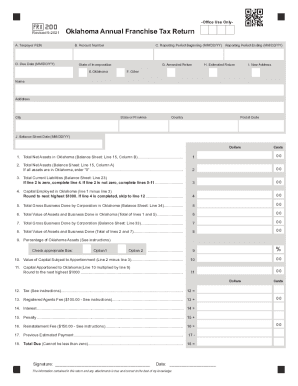

Otc Form Frx200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

Otc Form Frx200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

Form 200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

Otc Form Ef V Download Fillable Pdf Or Fill Online Business Filers Income Tax Payment Voucher For Form 512 512 S 513 513 Nr Or 514 Oklahoma Templateroller

Incorporate In Oklahoma Do Business The Right Way

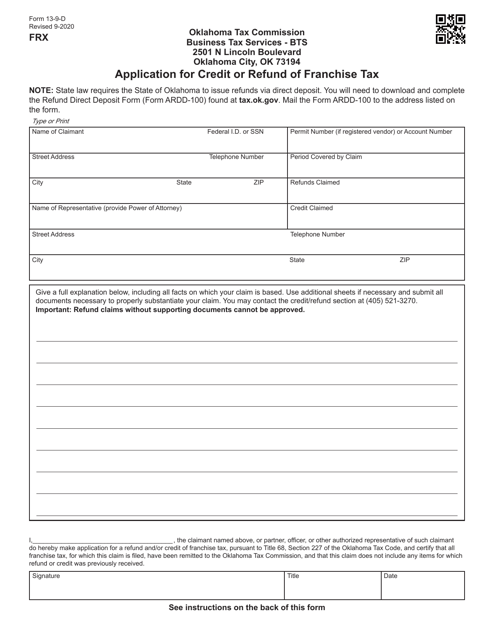

Form 13 9 D Download Fillable Pdf Or Fill Online Application For Credit Or Refund Of Franchise Tax Oklahoma Templateroller

Oklahoma Tax Reform Options Guide Tax Foundation

Oklahoma Tax Commission Facebook

Costs Fees To Form And Operate An Llc In Oklahoma Simplifyllc

Get And Sign Income And Franchise Tax Forms And Instructions Oklahoma 2021 2022

Incorporate In Oklahoma Do Business The Right Way